- #Virtual credit card terminal no monthly fees upgrade#

- #Virtual credit card terminal no monthly fees software#

- #Virtual credit card terminal no monthly fees plus#

- #Virtual credit card terminal no monthly fees free#

Payment gateway fee: $15 per month (average).A quick call with a PaymentCloud representative, however, gave us an overview of their rates: However, this does not come as a surprise-most high-risk merchant account providers do not disclose pricing because rates are customized to each business.

PaymentCloud is the only virtual terminal provider on our list that does not have any publicly disclosed pricing.

#Virtual credit card terminal no monthly fees upgrade#

It does this through PayTrace, which requires you to upgrade to a higher membership plan. While we prefer Chase Merchant Services for B2B sales, Payment Depot also offers credit card processing with Level 2 and 3 rates. Other FSB reviewers have had similar experiences, and the user reviews also call out the great service. The support person was friendly, helpful, and did not try to hard-sell me anything. I sent a question via the contact form and got a call minutes later.

We give Payment Depot kudos for customer support. It reprograms your POS equipment for free. However, Payment Depot itself integrates with QuickBooks, POS systems, and other software.

#Virtual credit card terminal no monthly fees software#

Your sales representative will help you find the best one, along with POS software and equipment.īecause of the choice of virtual terminals, the specific features will vary. For higher plans or specific situations, you may do better with PayTrace or NMI. Unlike most of the products on this list, Payment Depot does not have its own virtual terminal, but gives you a choice of several, depending on your plan. Payment Depot offers several virtual terminals, depending on the plan you purchase. We've also liked Payment Depot for general merchant services and restaurant payment processing. However, chargeback protection is included in its membership price, and it fares well for ease of use, integrations, and reputation. It lost the most points for its steep monthly fee. Like most on this list, it loses points for not supporting high-risk businesses. The virtual terminals generally don't include inventory-check Square for that. Payment Depot earned 3.81 out of 5 in our evaluation.

#Virtual credit card terminal no monthly fees free#

It offers a choice of free third-party virtual terminals and makes our list for the strength of the payment processing. While it does not work for high-risk businesses or businesses outside the US, it is worth considering for any business with high-ticket sales. Payment Depot is one of our top picks for the cheapest credit card processing companies, and that includes virtual terminals. If you do high-volume sales, then a payment processor with interchange-plus pricing can save you hundreds to thousands of dollars, even when considering a monthly fee. Square charges extra for this, while PayPal will send money immediately but only to your PayPal account. All you need to do is discuss this when setting up your account.Īnother advantage Chase has over other merchant services is that, with a Chase bank account, you can get your funds the same or next day. You may also be able to process international currencies and electronic checks like PayPal. Unlike many virtual terminals on our list, Chase supports Level 2 and Level 3 card processing, which can get you better rates. It lets you process purchases and refunds and allows splitting of shipments, something we did not find in other virtual terminals, but which makes it well suited for sales that might need a deposit. However, Chase has its own-Orbital Virtual Terminal. If you prefer to use with Chase, you can start accepting payments over the phone. (Source: Chase)Ĭhase lets you have a choice of virtual terminals.

Payment Depot: Cheapest option for established high-volume businesses.Clover: Best for businesses that want to choose their merchant service.PayPal: Best for freelancers, occasional sellers, and cross-border sales.Chase Payment Solutions: Best for B2B sales.

#Virtual credit card terminal no monthly fees plus#

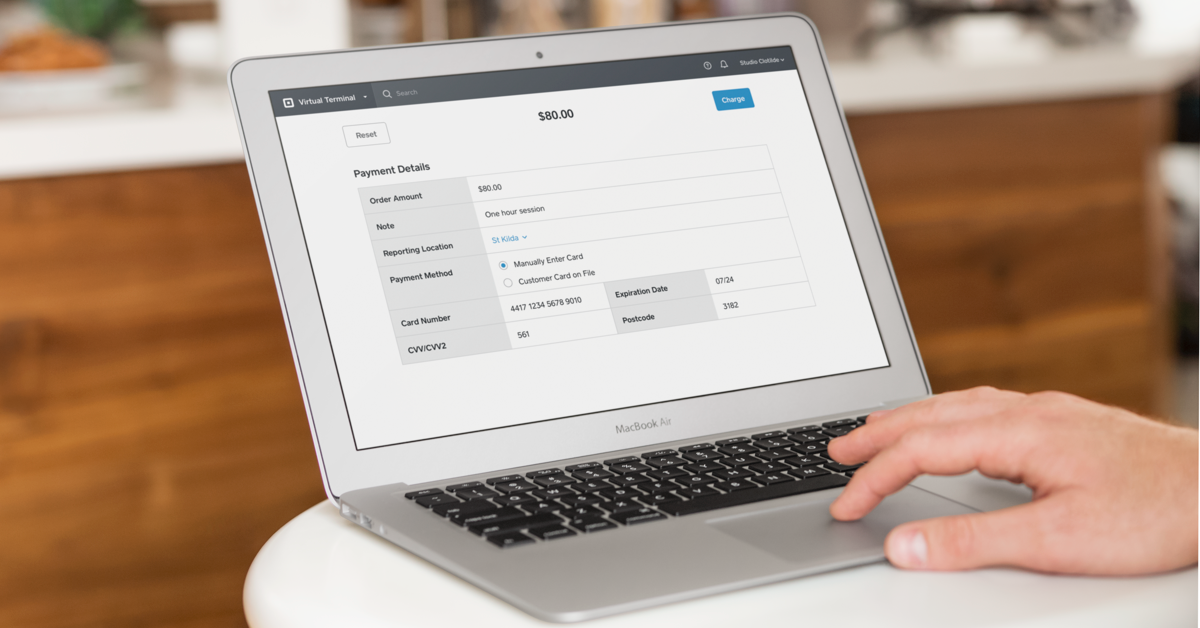

Merchant account transaction fees are higher than in-person transactions, though-it's usually 3.5% plus 10 cents to 15 cents per transaction. Secure virtual terminals are available from almost any payment processor and require no special equipment. The best virtual terminals also let you send invoices and create recurring payments, making them good for billing. A virtual terminal lets store owners manually key in credit card numbers when they receive phone, invoice, or mail orders.

0 kommentar(er)

0 kommentar(er)